by Karla Dennis | Sep 20, 2018 | Blog

Using the Law of Attraction to Boost Your Income We’ve all heard about how positive thinking can benefit you in many ways, but did you know that positive thinking and the Law of Attraction can help boost your income as well? These days we all could use some extra income! This article will give you an understanding of how positive thinking and the Law of Attraction are interrelated, as well as explain how you can use these principals for your financial benefit. Positive Thinking Positive thinking is more than just being upbeat all the time. The term “optimistic” comes to mind; however, positive thinking is much more than just being hopeful, also. Positive thinking is the opposite of negative thinking. read...

by Karla Dennis | Sep 18, 2018 | Blog

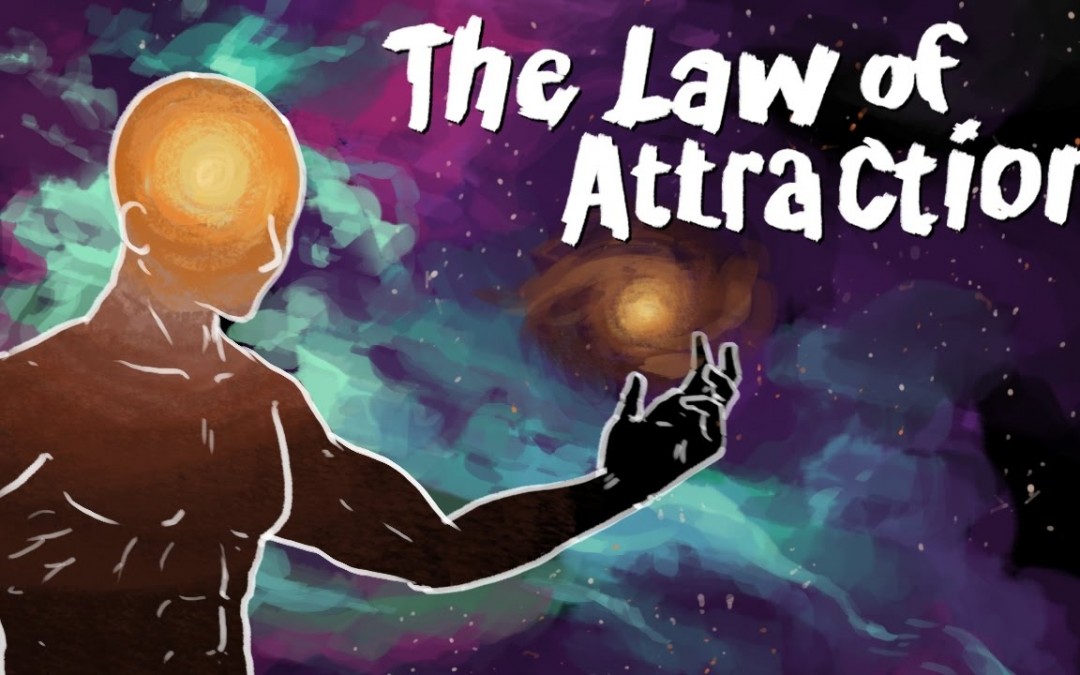

When you buy a home, you may wonder who should pay for the first year Real Estate Taxes? The seller should pay the taxes from the beginning of the year until the date of closing, and allowing the buyer to pay the taxes due after closing to the end of the year. Resulting in each party to pay for taxes during the time they owned. Seller-Buyer Split of Real Estate Taxes In the event, the seller has already paid the taxes for the entire year. Then the buyer should reimburse the seller for the prorated share. If all of the taxes are still owed, then the seller should be charged a prorated share placing that amount in escrow. Tax payments are arranged through the sale contract when buying or selling a home. The written offer will stipulate the requirements, which would be each party pay their portion of the tax. read...

by Karla Dennis | Sep 7, 2018 | Blog

Can taxes affect your favorite NFL team? According to the American Accounting Association (AAA), there is. According to a paper presented, by Matthias Petutsching of the Vienna University of Economics and Business, “there is a significant negative relationship between the performance of NFL teams and the personal income tax rates of their home states.” The paper goes onto say that higher-tax states can inhibit a team from attracting a quality player. NFL players are paid well, and for that reason, they are considering the tax implications when choosing a team and how it will affect their bottom line. Often players well negotiate for a higher contract to compensate for the high tax rate. Unfortunately, with a strict salary cap, a team may be unable to meet the demands, leaving the player to play for a team in a low-tax state. read...

by Karla Dennis | Sep 6, 2018 | Blog

Deemed personal exemption amount introduced for various tax benefits The IRS on Tuesday announced that it plans to issue regulations providing that the reduction in the personal exemption amount to zero for tax years 2018 through 2025 will not be taken into account in determining whether a person is a qualifying relative under Sec. 152(d)(1)(B) (Notice 2018-70). Accordingly, in defining a qualifying relative for purposes of various provisions of the Code that refer to the definition of a dependent in Sec. 152, including for purposes of the new $500 credit for other dependents under Sec. 24(h)(4) and head-of-household filing status under Sec. 2(b), the exemption amount will be treated as $4,150 (adjusted for inflation). read...