by Silvana Jimenez | Aug 29, 2016 | Blog

There are so many financial ratios, it’s challenging to know which of them matter the most. Understanding a few of the most basic ratios will allow an investor to determine if additional scrutiny is warranted. Fortunately, all financial ratios use simple arithmetic learned by second grade. The key is understanding the message a particular ratio delivers. The entire story of a company is never revealed by the numerous financial ratios, but a lot of valuable information can be discovered and applied to make a final investing decision. read...

by Silvana Jimenez | Aug 22, 2016 | Blog

It’s quite easy to become a 401(k) millionaire if you get started early enough. It’s also important to avoid making silly mistakes. Fewer people are able to retire at 65 than at any time in recent history. 30.8% of those over the age of 65 are working to make ends meet. With a 401(k) and some diligence, you can avoid becoming one those forced to work in your senior years. Become a 401(k) millionaire by following a few simple rules: Get the full company match. Every company is different. Some match 50% of the first 4% of your income contributed to the 401(k) plan. Others might match dollar for dollar on the first 5%. Ensure that you’re at least getting the full match amount. It’s free money, so ensure that you get it. Maintain your job. It can take a few years to be fully vested. So the money that your company contributed to your 401(k) in the last couple of years probably won’t be yours if you leave for another company. Of course, if a new job provides a greater income, a lower cost of living, or a more generous 401(k) program, it’s worth considering. Pull out your calculator and do the math before you take a position with another company. Take everything into account. Time is the deciding factor. There’s a limit to how much you can invest in a 401(k) each month. And unless you have a high income, it’s unlikely you can reach the contribution limit of $18,000 or $24,000 if you’re over age 50. That means that getting started early is important. Becoming a...

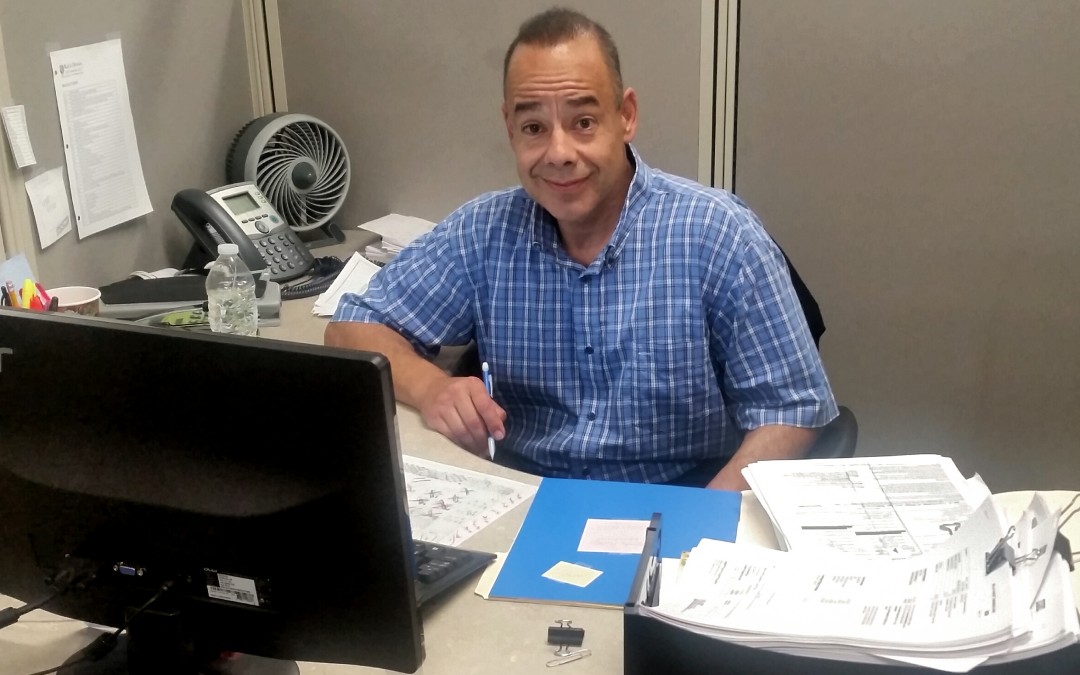

by Silvana Jimenez | Aug 17, 2016 | Blog

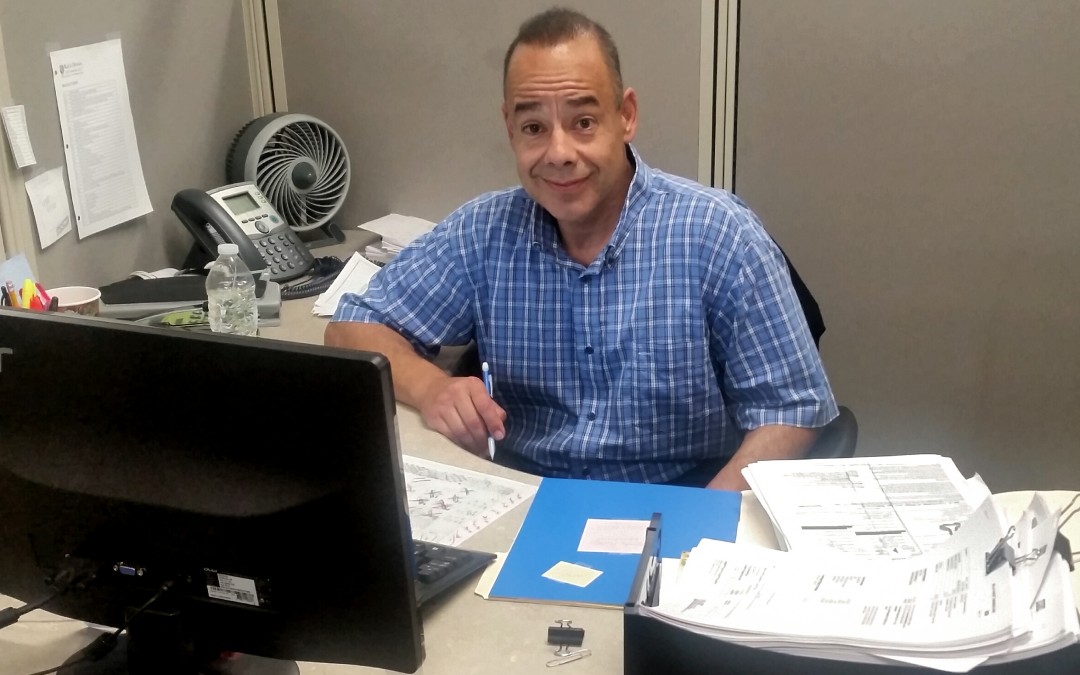

Meet Michael Lubin, one of our KDA top accountants. He has recently become part of our family and KDA could not be happier to have him as part of our team. Michael is known for always striving for excellence and contributing to KDA standards with his work ethic. Get to know Michael a little more through this interview Where did you grow up? I grew up in the Inland Empire. I spent my younger years in Norco and the remainder were spent in Riverside. What let you to becoming a CPA? Majoring in accounting in college and later on getting a job with a CPA firm in Irvine. What skill would you like to learn and why? Right now, it’s how to do taxes with the Ultra-tax. What was your first ever job? A part-time job with a family business. I did invoicing for them. I was probably 19 then when I got that job. I only had to work a few hours a day which was pretty cool. The Powerball jackpot is around $400 million right now. What would you do with this money if you won? read...

by Silvana Jimenez | Aug 15, 2016 | Blog

You are legally required to carry insurance for your vehicle, but this doesn’t mean you should overpay for your coverage. The monthly premium your insurance provider charges is a recurring expense that will impact your budget, so it’s important to look for an affordable option. It is possible to purchase the kind of coverage you need, protect your vehicle, and save money if you take the time to shop around and select the right provider and policy. Start by finding out more about how much insurance you’re required to carry. There are laws specific to each state regarding how much coverage you need. read...

by Silvana Jimenez | Aug 8, 2016 | Blog

Saving money isn’t always exciting, but a rainy-day fund is imperative to your financial health. It only takes one unexpected expense to topple your finances. The lack of an emergency fund can result in taking on additional debt or not being able to pay for a critical expense, like your child’s braces. There are several reasons you might require a rainy-day fund: Medical bills. It’s no secret that medical care is outrageously expensive in the United States. A simple out-patient operation, like a hernia repair, might only take 30 minutes. But it can easily cost $15,000 or more. How long would it take you to pay back $15,000? Even if you have insurance, you might still be on the hook for a deductible of several thousand dollars. Automobile repairs. Once the warranty has expired, your automobile has the potential to become a financial disaster. Once you’re no longer making an automobile payment, continue making the payment to yourself. Save the money for future repairs or your future automobile. At some point, all cars become more expensive to fix than they’re worth. Ensure that you have the funds in place to minimize the amount of debt necessary to obtain a new car. Currently, 10-12% of us will be without a job at some point in the next 12 months. Over the course of a lifetime, the number is much larger. Could you survive for at least 6 months until you find another job? What would happen to your family, home, car, and insurance? Major home repairs. Replacing a roof, a/c unit, furnace, repaving the driveway, or replacing appliances can...