Tax season opened with a bang and April 15th will be here before you know it. The Internal Revenue Service expects to process nearly 150 million individual 2015 tax returns by the time tax season comes to a close . Are you still wondering if you be filing one of those returns? And more important, do you need to?

For the 2015 tax season tax return, you should report the income that you received in 2014. That includes pay received in 2014 but not pay you receive in 2015 for services performed in 2014 (you’ll report that income next year).

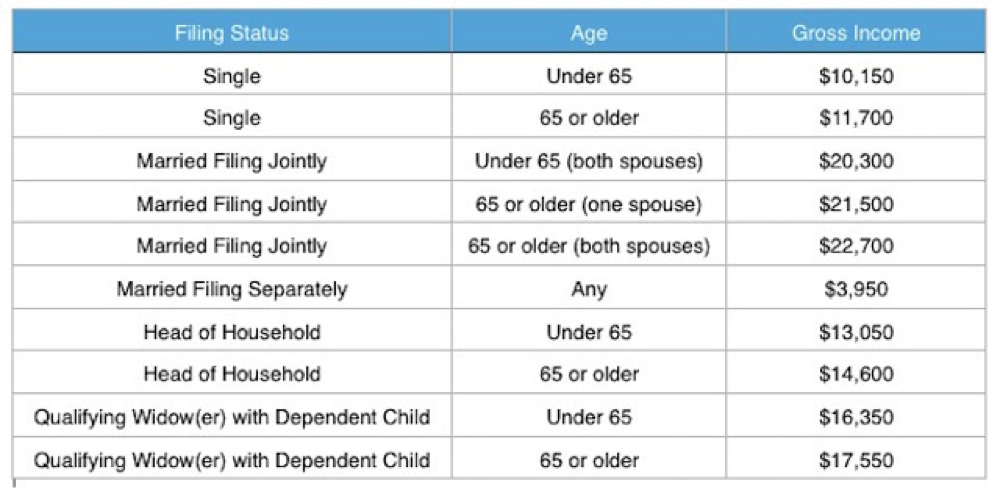

Not every body who received income in 2014 has to file a federal income tax return. There are a number of factors that affect whether you have to file including how much you earned – and the source of that income – as well as your filing status and your age. For most folks, this is pretty straightforward.

Using the chart below, choose your filing status, your age and your gross income for the year. If your gross income is above the threshold for your age and filing status, you should file a federal income tax return. These rules apply if no other person claims you on their federal 2015 tax return.

For most taxpayers, the quick “cheat sheet” formula is this: Find your standard deduction and add your personal exemption to that number (Remember to consider the increased standard deduction for those over age 65). You can find those numbers here.

For purposes of figuring your age, if you were born before January 2, 1950, you are considered to be 65 or older at the end of 2014.

If you can be claimed as a dependent on someone else’s 2015 tax return, the rules are a little bit different and can get complicated. Give me a call if you questions regarding this information.

I can be reached by email at Karla@KarlaDennis.com or 800-878-4051.

Share This

Share this post with your friends!