ARE YOU PLANNING?

One of the biggest questions I get every year is how you can save money on your income taxes. The answer is simple: The best ways to save is to do Strategic Tax Planning. An STP, which is what I like to call it, really gives you and I an opportunity to work on restructuring your finances based on your history, income, goals and tax laws. If you have not engaged with me or my team in the last 365 days to do strategic tax planning, you are over paying your income taxes and losing money in other areas of your financial life.

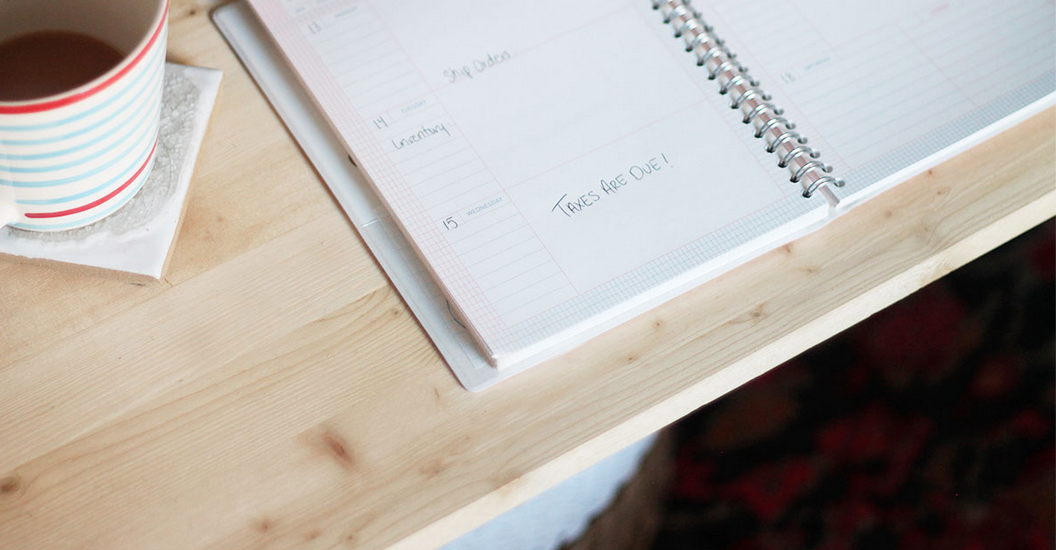

Tax season opened on January 20 this year, and already I have seen clients with thousands in missed opportunities. Some of these savings could have been in the form of lowered taxes and some of these savings could have been in the form of solid financial advice. Planning is priceless and if you are not doing it then you are losing money.

Strategic planning is not just a phone call where I go over your numbers and project what you will pay in taxes. It is so much more. I really take the time to understand what is going on in your life as well as your financial goals and objectives. Once I understand your goals, I take that information and search the tax code for strategies that pertain to your unique situation. I vet these strategies out with everything else you have going. I also look for opportunities to advise you in other financial areas that can save you money.

Here are a few examples of what I have done for clients just since January 1, 2015:

- Shifted some investment dollars around so a client’s college age child could qualify for full financial aid for college even though the parents’ made over six figures.

- Restructured a client’s business entity and eliminated $7,500 in tax.

- Eliminated one client from paying into social security tax while drawing social security

- Showed a client how to get their life insurance to be tax deductible there by reducing their tax bill.

- Helped a client get their child’s private school tuition discounted by over 50%

- Lower a client’s taxes by showing them how to write off their job hunting expenses.

- Helped a client negotiate his new employment contract for the best tax advantages for his overall financial picture.

- Helped a client who was audited to redo their audit and get their money back.

- Showed another client how to get an additional $2500 per month to help take care of her aging father.

- Prevented a client from being taxed on money left to him when his mother passed.

- Helped a client get principal reduction on her mortgage even though she was not behind on her house payment.

Strategic tax planning is key to help you save money with your overall finances. Income taxes maybe one of your biggest expenses but it is not the only expense. Please contact me today at 800-878-4051 to set up your planning appointment.

Hugs,

KarlaD

Share This

Share this post with your friends!